But how do they work together? Why is a strong connection between them so important? In this blog, we will walk you through the differences between payroll services and HR services, their roles, responsibilities, processes, and highlight how they work together to support the workplace.

Payroll responsibilities

Payroll responsibilities

When it comes to salaries, it's all about payroll. Their job? Making sure employees get the right amount, on time, every time. But it's not just about paying employees. The payroll department processes payroll taxes, benefit deductions, and bonus payments, ensuring all benefit deductions are made correctly. Beyond payroll duties and salary processing, payroll also plays an important role in financial and tax reporting, keeping the company compliant with tax regulations.

Most businesses handle payroll through the HR or finance department or hire payroll professionals to handle payroll software. This software helps payroll professionals track work hours, time off requests, and off-cycle payments like bonuses and maternity pay. Payroll professionals running payroll are also responsible for ensuring the pay stubs are updated and payroll reporting is accurate and ready for financial reporting.

HR's responsibility

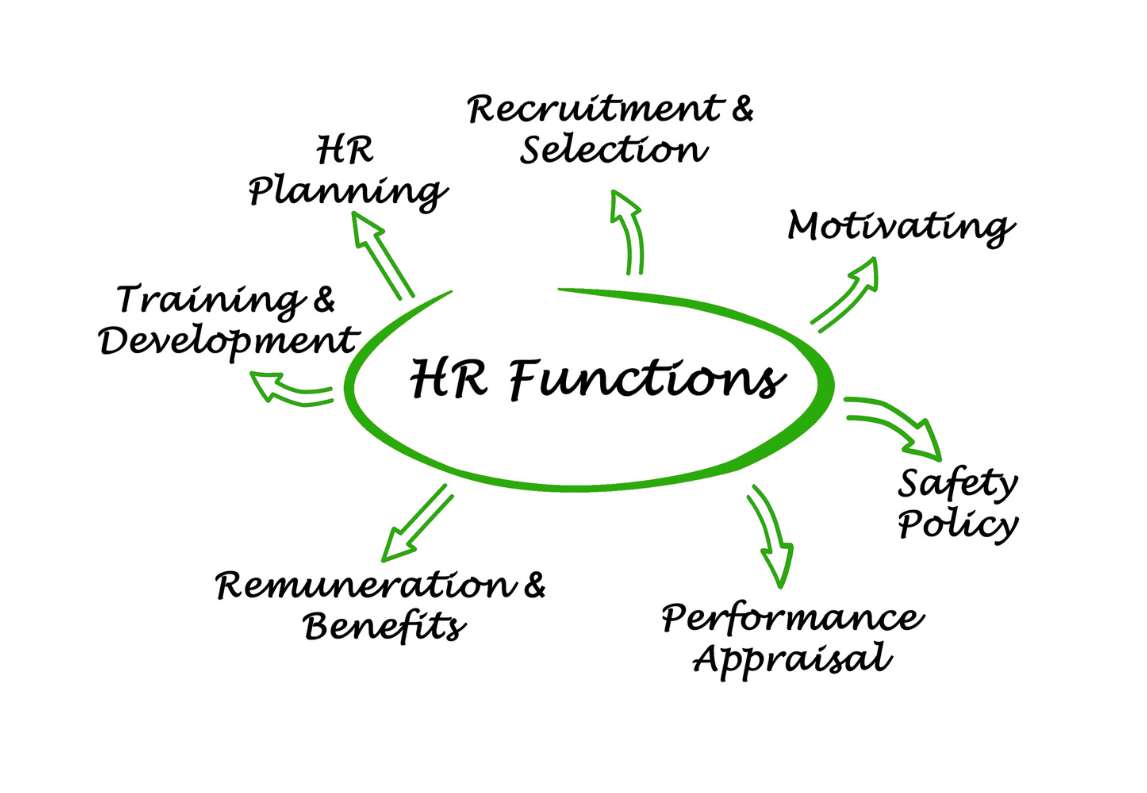

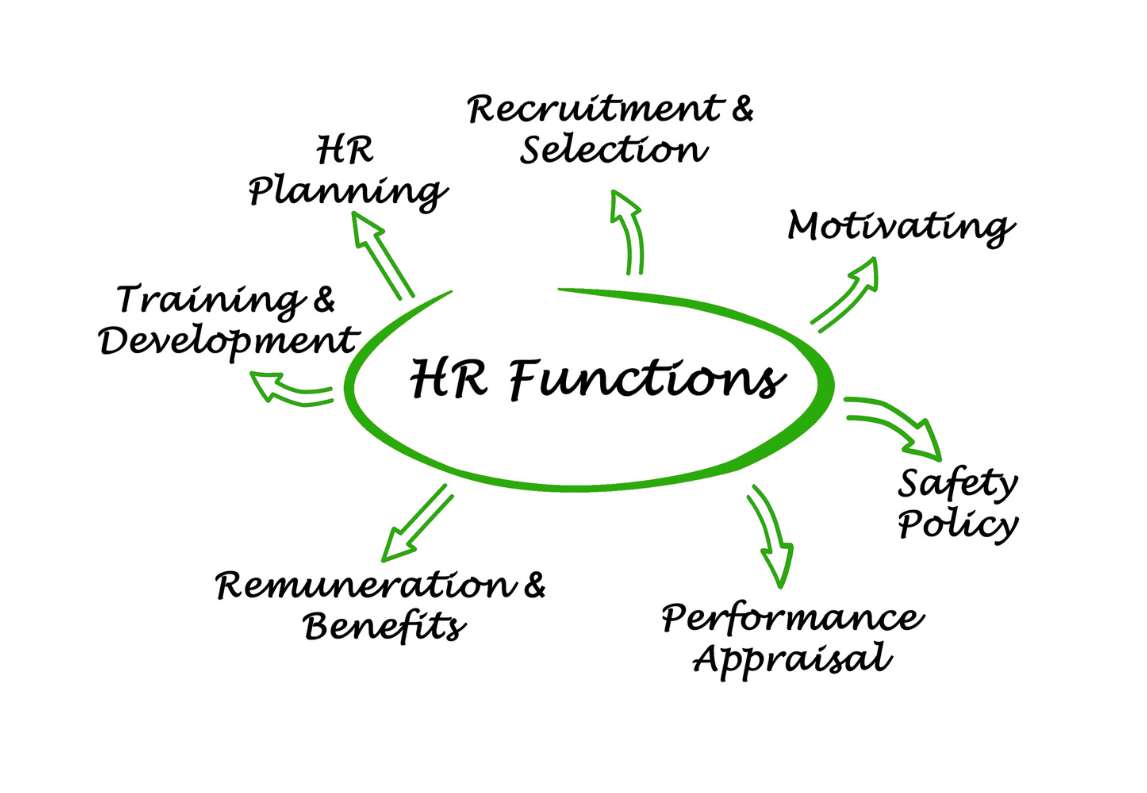

The Human Resources department is the glue that holds everything together in the company. They handle everything from hiring and onboarding to performance management. HR professionals also take care of training and ensuring employee benefit packages are competitive and compliant. Moreover, they handle HRMS systems, where all current employee data and information are stored and maintained.

Human Resources also focuses heavily on the employee experience, helping to motivate teams, maintain a strong company culture, and provide ongoing professional development.

Payroll services vs. Human Resources

While both departments handle employees, their responsibilities are clearly defined. Payroll is all about the numbers, like processing employee pay and handling payroll taxes and wage reductions. On the other hand, Human Resources focuses on managing the broader employee relations and experience, ensuring policies are in place, labor laws are followed, and employee benefit packages are competitive.

The overlap of HR vs Payroll functions

By now you know what payroll and HR do and how different they are. But you should also know they're constantly crossing paths because they both directly affect payroll. Hence, a lot of overlap in their responsibilities.

For example, human resources hires a new employee and sets them up in the payroll system. Payroll takes over and manages payroll and ensures the employee is paid correctly according to the information HR has entered.

HR and payroll also overlap with time off as HR has employee information and tracks holiday pay, sick leaves, and vacation days, and payroll ensures those absences are reflected in the employee's paycheck. Managers also rely on this data to plan schedules and approve time-off requests.

Benefits are another shared responsibility. The HR department creates policies for employee pay like health insurance and retirement plans, but the payroll administrator's job is to make sure the right deductions are taken from each paycheck.

Common challenges HR and payroll face

Even when HR and payroll work hand in hand, things don't always go as planned. With both teams relying on the same data, even a minor oversight can lead to bigger issues.

For payroll changes, if HR doesn't update the system with an employee’s new role, salary adjustment, or personal information, payroll management might process incorrect payments or deductions. This could lead to compliance risks, discrepancies in tax information, gross pay, or benefits, and potential legal issues and financial penalties. Similarly, errors such as delayed salary increases, incorrect tax deductions, or errors in benefit payments can also frustrate employees. Over time, these issues don’t just cause internal dissatisfaction; they can also hurt a company’s reputation.

To avoid these problems, many businesses use HRMS systems and other payroll management software that help integrate payroll functions and improve payroll data's accuracy and communication.

HR and payroll: separate functions?

The above explanation leads to a common question:

Should the HR department, and the payroll department, be kept separate?

The differences between the HR functions and Payroll are primarily related to money, and accuracy is crucial when it comes to finance. Payroll errors can result in compliance issues, financial penalties, and unhappy employees. That's why companies prefer the finance department to handle all payroll responsibilities rather than merging payroll and HR functions.

By maintaining separate functions with distinct reporting structures, companies create a clearly defined role separation so that each department can focus on its core.

The Future of Payroll and HR

As we’ve seen, HR and Payroll have traditionally operated as separate functions, each with its responsibilities. But, as technology advances, the line between them is becoming increasingly blurred. Businesses are looking for ways to ease processes, reduce errors, and enhance collaboration where automation plays a major role in making that happen. Cloud-based systems allow real-time payroll data sharing, ensuring payroll accuracy and better team collaboration. Employees also benefit from self-service portals, giving them easy access to payslips, tax forms, and benefits information, enhancing overall transparency.

Beyond efficiency, there’s a growing focus on employee experience, as payroll accuracy directly impacts job satisfaction and retention. Companies are investing in smarter payroll processing systems and HR strategies to provide timely, error-free compensation and flexible payroll options. Whether these functions remain separate or merge into a single department, the future of global payroll lies in leveraging technology to create a supportive work environment.

Outsourcing Payroll Processing

As HR and other payroll processing functions become more integrated through automation and cloud-based systems, many companies are also exploring outsourcing payroll processing, as a way of making their operation smoother. Just as technology has enhanced efficiency, outsourcing payroll functions allows businesses to reduce costs, minimize errors, and ensure compliance with complex tax laws all while freeing up internal resources for more strategic priorities.

By partnering with outsourcers like Hilfort, you can reduce the risk of miscalculations, and tax laws, maintain financial data accuracy, ensure compliance, and free up internal resources by letting HR professionals and the finance department focus on their core tasks.

FAQs

-

Why does payroll matter so much if HR handles all employee benefits?

While the HR department focuses on hiring, benefits, and the overall employee experience, the payroll team's goal is to ensure the finances, like calculating wages, and tax deductions, and making sure employees get paid correctly. These two departments work hand-in-hand to keep employees happy and ensure everything runs smoothly.

-

How do HR and payroll teams stay on the same page?

Communication is key! HR handles employee data, like hiring and role changes, and passes that along to payroll to ensure salaries, deductions, and bonuses are all calculated correctly. Without solid communication and efficient systems, things can slip through the cracks, leading to frustration for employees and management.

-

Is it better to outsource payroll services or keep it in-house?

That depends on the size and needs of your business. Outsourcing your payroll functions can save time, reduce the risk of errors, and keep you compliant with ever-changing tax laws. It frees up HR and finance teams to focus on strategic priorities. But, if you have a small team, in-house payroll functions might work just as well. The key is to find a solution that fits your company’s needs and ensures smooth payroll operations.

Conclusion

Running a business means balancing many moving parts, and the HR department and payroll department are two of the most important. While they each have their roles, the magic happens when they work together. With the right tech, payroll and the HR department can be more efficient, reduce mistakes, and stay on top of the ever-changing rules. And if you’re finding the workload a bit much, Hilfort can always lighten the load with your payroll and HR.

Payroll responsibilities

Payroll responsibilities

-1.png?width=446&height=493&name=Ditta%20van%20Gent%20Fotografie-45-1%201%20(1)-1.png)